40% of small business owners—your customers—consider themselves to be financially illiterate. They don’t understand how financing, credit cards, and cash flow work. Many customers will default to swiping a credit card, even if it isn’t the best option for them.

Here are 5 reasons to offer a variety of financing options, beyond just cash and card.

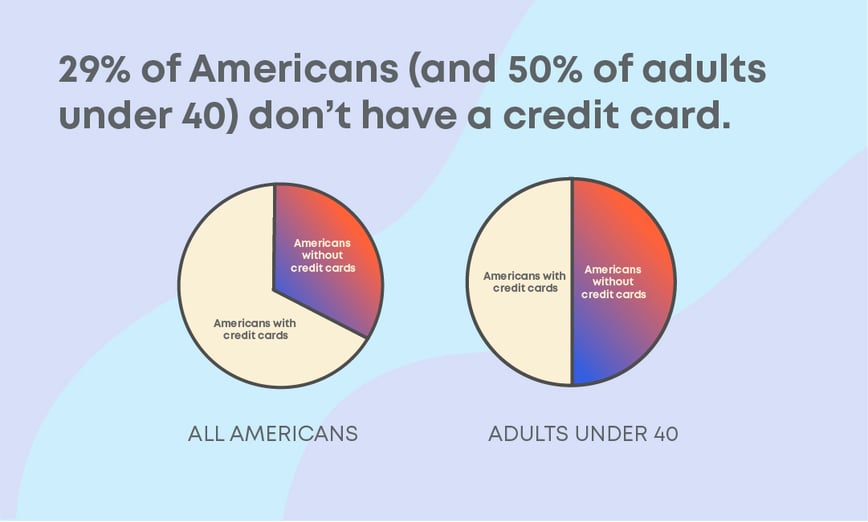

1. Not all customers have a credit card.

1. Not all customers have a credit card.

29% of Americans (and 50% of adults under 40) don’t have a credit card. And cash isn’t always an option, especially for an urgent purchase.

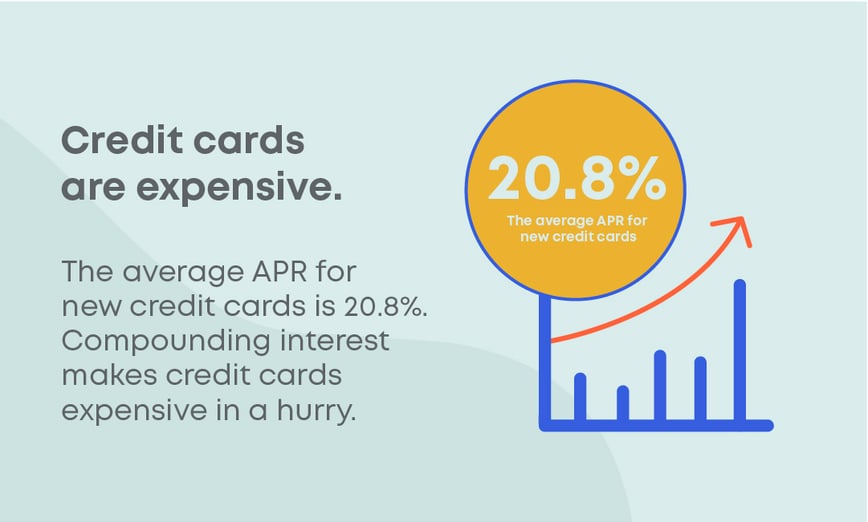

2. Credit cards are expensive.

2. Credit cards are expensive.

The average APR for new credit cards is 20.8%. Compounding interest makes credit cards expensive in a hurry.

3. Credit cards are unpredictable.

3. Credit cards are unpredictable.

53% of active credit cards carry a balance. Carrying a balance can make it extremely difficult for a customer to know exactly what they’ll pay overall, especially since APRs are usually variable.

4. Customers want to save their credit limit.

4. Customers want to save their credit limit.

Experts suggest keeping your credit utilization rate below 30%. Putting a large expense on a credit card can impact a credit score long-term. Clicklease doesn’t affect credit utilization rate—and saves available credit for other expenses.

5. Credit card processing fees add up.

5. Credit card processing fees add up.

Credit card companies add fees to every single transaction that can add up to 5% of the total price. That can add up quickly.

Clicklease is a great option for simple leasing for your customers. Customers will know exactly how much their payment will be and how many payments they’ll make. Applying won’t affect their credit and you can get an instant decision.

Clicklease is a great option for simple leasing for your customers. Customers will know exactly how much their payment will be and how many payments they’ll make. Applying won’t affect their credit and you can get an instant decision.

Plus, Clicklease is always free for sellers.

Learn more at clicklease.com